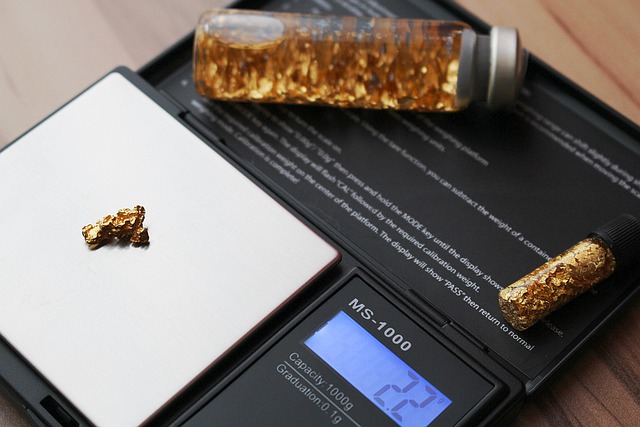

Rolling over a 401(k) to a Gold IRA allows individuals to invest in physical gold, diversifying retirement portfolios and offering benefits like wealth preservation. This process requires compliance with IRS regulations, tax assessment, and informed decision-making, with expert guidance recommended. Despite potential penalties for non-compliance and market fluctuations, the strategy provides a hedge against inflation and economic volatility, enhancing long-term growth and preserving wealth.

Looking to diversify your retirement savings? Discover the benefits and learn about the 401k to Gold IRA rollover process. This comprehensive guide explores direct rollover advantages, potential challenges, and tax implications, offering insights for optimizing your retirement portfolio with precious metals. Understanding this strategy can help you make informed decisions to maximize your financial future.

- Understanding the 401k to Gold IRA Rollover Process

- Benefits and Considerations of a Direct Rollover

- Navigating Potential Challenges and Tax Implications

- Optimizing Your Retirement Portfolio with Gold IRAs

Understanding the 401k to Gold IRA Rollover Process

The process of rolling over a 401(k) to a Gold IRA is designed to offer individuals a unique investment opportunity, allowing them to diversify their retirement portfolio with physical gold. It involves several steps that ensure a seamless transition of funds while maintaining tax efficiency. First, you’ll need to initiate the rollover by informing your current 401(k) administrator and choosing a Gold IRA provider. This provider will facilitate the transfer of funds from your 401(k) account to your new Gold IRA.

During this process, it’s crucial to ensure that all taxes are properly handled to avoid penalties. Once approved, the actual rollover occurs, giving you ownership of your gold assets within the IRA. This method provides an alternative investment strategy, offering potential benefits like preserving wealth through a historical store of value and diversifying risk in retirement accounts.

Benefits and Considerations of a Direct Rollover

A direct 401k to Gold IRA rollover offers several compelling benefits for individuals looking to diversify their retirement savings. One significant advantage is the potential for better investment returns. Gold, a traditionally safe-haven asset, can provide a hedge against inflation and economic volatility, which are common risks associated with traditional paper investments like stocks and bonds. This direct transfer allows investors to access gold as a core component of their retirement portfolio, diversifying their holdings and potentially enhancing long-term growth.

Considerations for this type of rollover include ensuring compliance with IRS regulations and understanding the tax implications. Direct rollovers are generally tax-free, which can be a substantial benefit in terms of preserving wealth over time. However, it’s crucial to assess one’s current tax bracket versus future projections to make an informed decision. Consulting with a financial advisor or tax professional is recommended to navigate these aspects successfully and maximize the advantages of transitioning from 401k to Gold IRA.

Navigating Potential Challenges and Tax Implications

Navigating Potential Challenges and Tax Implications

When executing a 401k to Gold IRA rollover, individuals must be aware of potential challenges that could arise during the process. One significant challenge is understanding the tax implications associated with such a transition. Both federal and state tax laws govern these rollovers, and failure to comply accurately can result in substantial penalties. It’s crucial to consult with a financial advisor or tax professional who specializes in IRAs to ensure proper documentation and timeliness.

Another common challenge is accurately assessing the value of assets during the rollover. Fluctuations in market values can impact the final amount transferred, so careful monitoring is essential. Furthermore, individuals must consider potential penalties for early withdrawals if they don’t meet the required conditions. By proactively addressing these challenges and seeking expert guidance, investors can ensure a smoother transition and maximize the benefits of their 401k to Gold IRA rollover.

Optimizing Your Retirement Portfolio with Gold IRAs

Optimizing Your Retirement Portfolio with a Gold IRA Rollover presents an innovative strategy for investors aiming to diversify and potentially enhance their retirement savings. By converting a 401k plan to a Gold IRA, individuals can access a unique investment opportunity that offers stability and growth in an uncertain economic climate. Gold has long been recognized as a valuable asset, serving as a hedge against inflation and market volatility.

This rollover option allows investors to directly invest in gold assets within their retirement accounts, providing both financial security and potential long-term gains. A Gold IRA offers a way to diversify beyond traditional stocks and bonds, offering a tangible asset with a proven track record during times of economic instability. This strategic move can be particularly beneficial for those concerned about the volatility of the stock market or seeking alternative investment avenues to complement their retirement savings.

A smooth transition from your 401(k) to a Gold IRA rollover can be a powerful step towards optimizing your retirement portfolio. By understanding the process, weighing the benefits and considerations, and being aware of potential challenges and tax implications, you can make an informed decision that aligns with your long-term financial goals. This strategic move allows you to diversify your investments with gold, potentially enhancing your retirement security in today’s economic landscape.